This surge of interest in precious metals is likely contributing to the millions of consumers flooding brokerages and reshaping the trading industry.

But while many prefer the volatility of short-term trading, huge swaths of the market are seeking shelter from uncertainty by investing in precious metals -- a traditional ‘safe haven’ asset.

One way of investing in silver is to buy silver bars. Regardless of the investments you usually make, buying bars can be an excellent way to diversify and balance your portfolio.

Understanding how to get the best deal or how prices are set will help you act with confidence and start growing your investment in physical assets.

Investing in Silver Bars

Silver has been used for centuries as a medium to preserve wealth. It's more affordable than gold, which makes it a popular investment choice.

Silver bars are manufactured by government mints, such as the Royal Canadian Mint and the Mint of Poland, or by private mints, such as Apmex.com and PAMP Suisse.

They are available in a wide range of weights, with common products ranging from 5 grams to a kilogram or even 33 kilograms.

It’s best to only purchase from a reputable, established dealer.

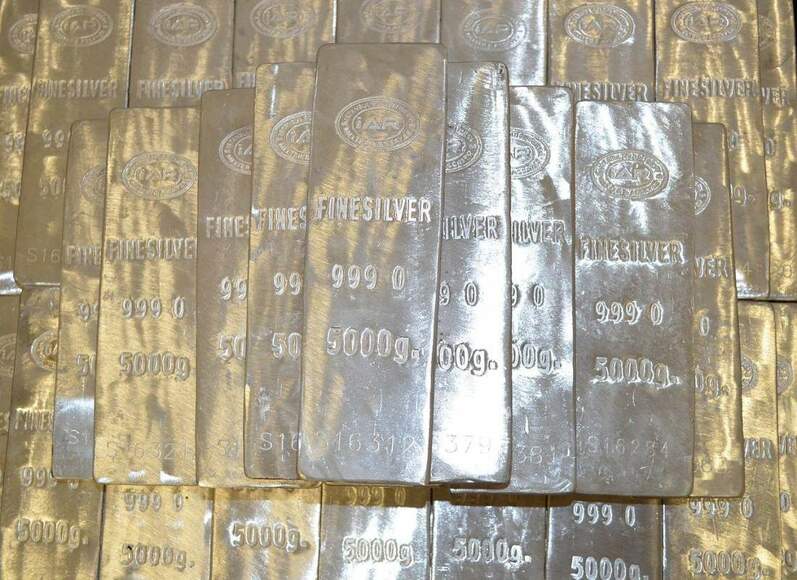

Silver bars commonly bear the stamp of the producer, the weight of the bar, and the purity of the silver in the bar, such as .9999.

Some bars — particularly larger bars — also have serial numbers engraved on them, but not all bars do. For example, one-ounce “hand-poured” private mint bars typically do not carry serial numbers.

Bars vs Coins

Silver can also be accumulated by purchasing coins. So how do you make the decision to buy bars or coins? Several countries, such as the United States, Poland, Canada, Austria, New Zealand, Australia, and the United Kingdom, mint silver coins each year.

Typically government-minted coins are going to be more expensive than ‘generic’ brand coins (called “rounds”) produced by private mints. And because the designs are more intricate than those on silver bars, coins typically carry a higher premium (as a percentage of spot price) than silver bars do. (We explain in the next section.)

Another option is to purchase junk silver coins, like old Mercury dimes or Standing Liberty quarters that contain a percentage of silver content.

To make a decision on buying silver coins vs. bars, it’s important to understand how retail silver prices are set.

Understanding How Prices Work

Silver is traded on regulated exchanges alongside other metals, such as gold and copper. When buyers and sellers agree to a transaction, it creates a set price per ounce of silver. That price per ounce — called the “spot price” — fluctuates during trading hours.

The price of silver bars and coins is based on the current spot price. However, wholesalers add a fee and the retailer adds their fee as well. Anything above the value of the silver itself is referred to as the “premium.”

During peak demand, the premium on silver bars and coins may rise.

How to Get the Best Deal

Silver bars can be purchased by using several methods. Three of the most popular options are:

- Online precious metals dealers

- Auction sites

- Local coin shops.

While getting the best deal can help save money, it's also critical to ensure that the purchased bars are authentic. Buying from an unknown seller on an auction site is probably a bad idea, regardless of what the price is.

Accumulating silver bars from an established coin shop or online dealer is usually the best choice. They should have a long track record, which helps to indicate their trustworthiness.

Getting the best deals can be done by looking for sales and free shipping. Also, several dealers will offer a discount if payment is made with a check or Bitcoin.

Realize that the larger the bar, typically, the smaller the premium will be as a percentage of the spot price.

Using the information we've discussed should make the process of buying silver fairly straightforward and safe. But remember that investing is always risky and there are unscrupulous sellers out there.

Note: The 35% year-to-date increase in silver’s price is based on the Wall. St. Journal’s tracking of the continuous front-month futures contracts, as accessed on Oct. 13, 2020.